Cash Store

Direct Lender*

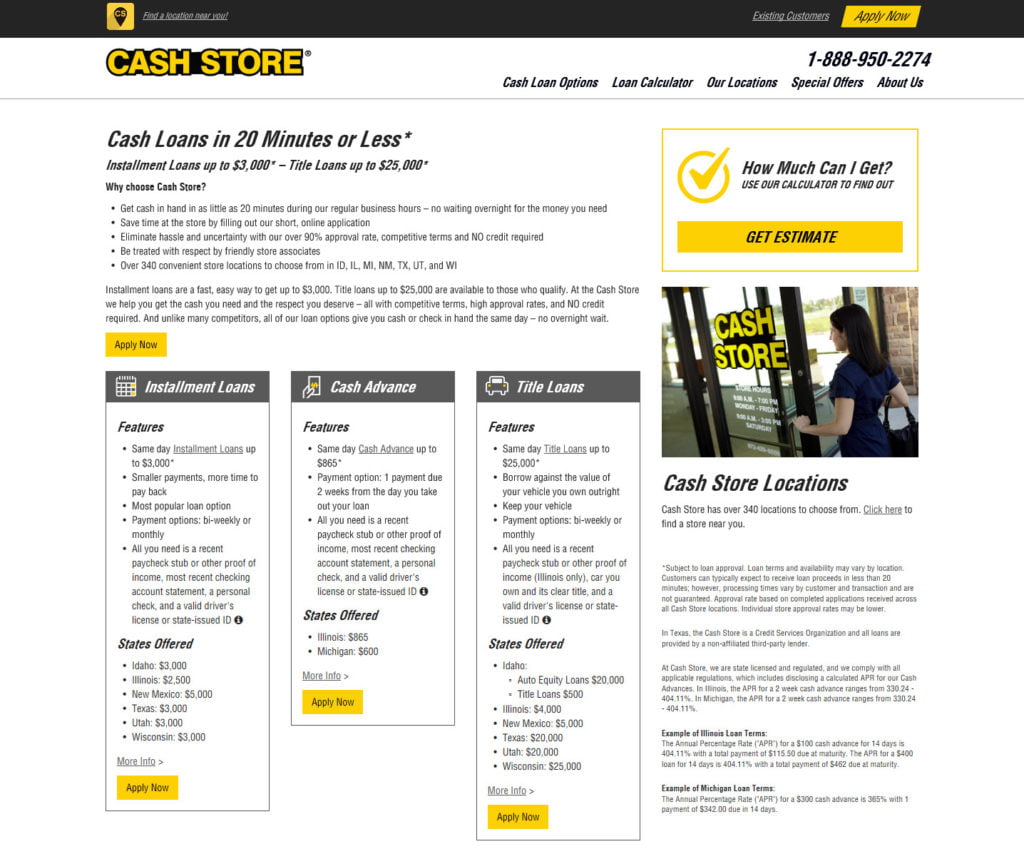

Direct Lender*Cash Store is a reliable and reputable financial products and services provider and a direct lender. The company offers a variety of loan options, including Cash Advance, Installment Loans, and Title Loans. Cash Store has been in business since 1996; the company has grown rapidly and currently operates over 340 store locations in 5 states.

Cash Store has more than 20 years of experience helping customers with emergency cash loans for unexpected expenses, delivering excellent customer service, providing competitive rates and terms, quick approvals, and same-day funding.

Cash Store has over 340 store locations in the following states:- Idaho, Michigan, New Mexico, Texas, and Wisconsin.

Cash Store is committed to the people they serve. It provides the best customer service possible, with the help of its professional and skilled team and over two decades of experience in the financial market. Their fully trained, knowledgeable, and qualified staff will work with you to locate which loan service works best for you and will make the entire loan application and approval process as simple as possible. Furthermore, with their secure, stress-free, quick cash services, you can have the cash you require in your hand within minutes, not hours!

Products and Services offered by Cash Store.

Cash Advance/Payday Loan

Cash advances, also referred to as payday loans, are designed to support people overcome short-term cash needs when unforeseen expenses occur and to create a small breathing space in your budget until the next payday.

A cash advance loan allows you a fast way to get cash when you need it, even with imperfect credit. The loan repayment term may vary depending on the state of residence. At Cash Store, you can also pay off your loan before the due date – whichever is most comfortable for you!

Cash Store currently provides cash advance in Michigan (up to $600*).

Cash Store is a state-licensed lender and complies with all applicable state laws and regulations.

Installment Loans

Cash Store provides access to installment loans, which are quick and easy to borrow and range up to $5,000*. An installment loan is an excellent alternative if you need urgent cash but at the same time need some additional time to pay it back.*

Installment loans can help you to bridge the gap in times of financial hardship – emergencies, car or home repair, or in covering any unexpected bills. Also, there is no need to be concerned about immediately paying your installment loan back in one single lump sum. Installment loans can provide you with the flexibility to repay the borrowed funds in multiple payments, which means you can comfortably schedule your due dates according to your pay date frequency (biweekly/monthly).

Cash Store currently provides installment loans in Idaho, Texas, Wisconsin (up to $3,000*), and New Mexico (up to $5,000*).

Title Loans

If you require quick funds, when stressed over unexpected bills, a family emergency, or due to an urgent maintenance expense, but you do not have any other alternatives left to borrow funds. A title loan might be the better choice.

To obtain an auto title loan, you will have to pledge the vehicle you own as collateral by providing your vehicle’s title to the lender till the borrowed funds are entirely paid back.

At Cash Store, you can get up to $25,000* depending on the valuation of your vehicle. You need a car having a free-and-clear title. Additionally, you can get yourself a title loan from Cash Store even if you have less than perfect credit or no credit. Furthermore, an additional benefit which you’ll find attractive is you get to keep using your car for the duration of the loan! Plus, the repayment schedule for your loan will be a series of convenient payments, giving you ample time to repay.

Cash Store currently provides title loan in Idaho (up to $500*); New Mexico (up to $5,000*); Texas & and Wisconsin (up to $25,000*). Auto Equity Loans are also available in Idaho (up to $20,000*).

Notice:- Vehicle is subject to evaluation for title loans and auto equity loans.

How to Get a Loan from Cash Store?

Getting a loan from Cash Store is easy and can be completed in 3 simple steps:

Apply Online.

Cash Store aims to provide its customers with a platform that simplifies the borrowing process and makes it quick and convenient. The company also believes in removing the complexity people often encounter while borrowing money.

The online application form is created using the latest technology, ensuring complete privacy and security of your personal information.

The application is built looking at the comfort of borrowers; on submitting the online application, your information is sent to the nearest local stores ahead of your visit. Also, you fill out one form for all available loan products, which allows you to save time when you visit the store to complete the approval process and discuss the final loan amount.

Visit the store.

Cash Store has 340+ locations in seven states, use the store locator tool on the website to locate the nearest local storefront for an in-person visit to complete the approval process. Be sure to carry the following documents:

For a Cash Advance or Installment Loan, bring in:

- A recent pay stub or any other proof of income.

- The most recent checking account statement.(account must be active for 30 days or more)

- A personal check (and/or debit card in NM, TX and WI only)

- Valid driver’s license or state-issued ID.

For a Title or Auto Equity Loan, bring in:

- Bring the vehicle you own along with the free and clear title.

- Valid driver’s license or state-issued ID.

- Illinois residents should carry recent pay stub or other proof of income.

Get Your Cash.

The store staff will verify the documents and complete the approval process; once approved, you can walk out with your cash the same day. It’s that easy.

Notice:

In Texas, the Cash Store is a Credit Services Organization and Credit Access Business. Loans are provided by a non-affiliated third-party lender.

*Subject to loan approval. Loan terms and availability may vary by location. Customers can typically expect to receive loan proceeds in less than 20 minutes; however, processing times vary by customer and transaction and are not guaranteed.

*Approval rate based on complete applications received.

Service Details

Safety | 256-Bit SSL Verified by Symantec Corporation. |

State Licensed | Yes, Cash Store is state-licensed and regulated and complies with all applicable regulations. |

Loan Amount | Cash Advances up to $865*. |

APR | APR varies by state |

Loan Period | Loan Period varies by state |

BBB Rating | Business is not BBB Accredited |

Credit Score Required | NA |

Funding Time | Customers can typically expect to receive loan proceeds in less than 20 minutes; however |

Notice:

In Texas, the Cash Store is a Credit Services Organization and Credit Access Business. Loans are provided by a non-affiliated third-party lender.

*Subject to loan approval. Loan terms and availability may vary by location. Customers can typically expect to receive loan proceeds in less than 20 minutes; however, processing times vary by customer and transaction and are not guaranteed.

*Approval rate based on complete applications received.

States Serviced by Cash Store

The states serviced may change without prior notice, visit the lender’s website for up to date information.

Cash Advance/Payday Loans

- Michigan

Installment Loans

- Idaho

- New Mexico

- Texas Serviced as Credit Access Business(CAB).

- Wisconsin

Title Loans

- Idaho

- New Mexico

- Texas Serviced as Credit Access Business(CAB).

- Wisconsin

Notice:

In Texas, the Cash Store is a Credit Services Organization and Credit Access Business. Loans are provided by a non-affiliated third-party lender.

*Subject to loan approval. Loan terms and availability may vary by location. Customers can typically expect to receive loan proceeds in less than 20 minutes; however, processing times vary by customer and transaction and are not guaranteed.

*Approval rate based on complete applications received.